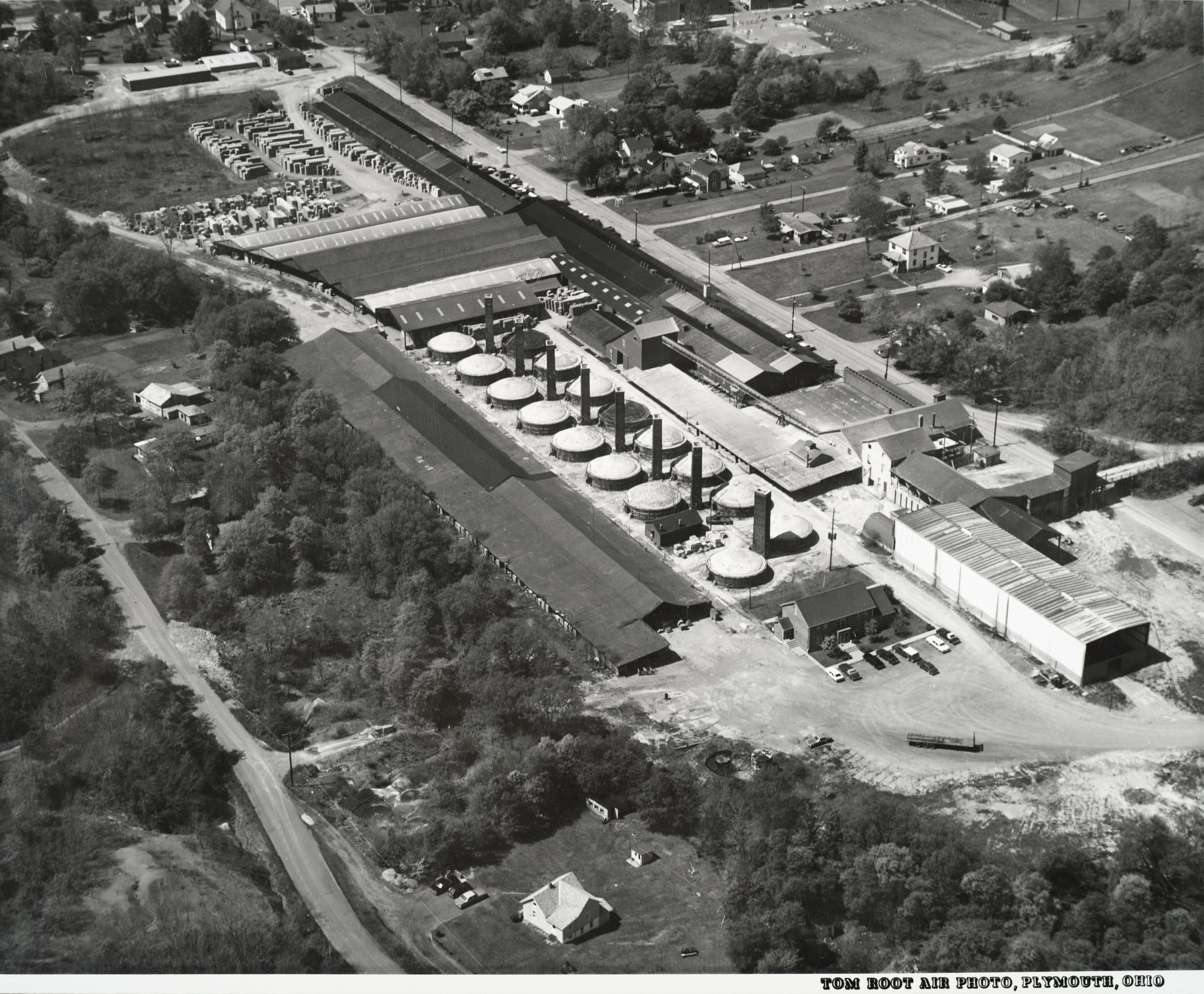

Red was still the color of choice in the paver market. The red burning shale in the Waynesburg/Magnolia area had severe limitations. Recalling that during a 1953 visit to Summitville Tile, arranged by Harry Keagler (a large face brick and ladle brick distributor for WG), both Harry and Fred Johnson extolled the virtues of “the best shale in Ohio,” which was used to produce the famous “Summitville Reds.” Alliance was close to Summittville, so we arranged to get the shale, Buffalo shale, from an adjoining farm and found it to be excellent for dry pressed paver manufacture.

At this time we solved, for the time being, two long-standing problems. First, the health and pension benefits, which we had agreed to provide 30 years ago in our labor agreement with the union, had become unaffordable. Second, work of handling heavy clay products was so draining that after 20 years, many employees could not continue to do that work, so we had to provide lighter work such as lift driver, bricklayer and bricklayer helpers. Many were barely capable of the jobs available and there were not enough lighter duty jobs to take care of the aging pieceworkers. It was like professional football. the careers were limited, but in our case after the career ended, we had an obligation to provide employment for many more years.

One of the earliest remaining dry pressed paving projects is shown below. Morris Civic Plaza, South Bend, IN.